14 Nov 2025

|29 min

Generative UX research methods

Learn how to choose, execute, and combine generative UX research methods to uncover deep user insights that drive breakthrough product innovations.

Generative UX research is all about diving deep into users' worlds to uncover hidden insights that can drive innovation. It draws heavily on various qualitative research types to explore user behaviors, motivations, and unmet needs from the ground up.

But how do you get there?

This comprehensive guide explores the most impactful generative research methods and shows you how to crack the code on what makes your audience tick. From in-depth interviews to cultural probes, you'll discover when to use each method, how to execute them effectively, and how to turn your findings into breakthrough product innovations.

Key takeaways

Method selection matters: Choose research methods based on your specific goals, timeline, and resources. Quick insights need different approaches than deep behavioral understanding.

Combine methods strategically: The most powerful research uses multiple methods together – surveys to identify themes, interviews for deep insights, and observation to see real behavior.

Essential methods: User interviews, field studies, contextual inquiry, diary studies, co-creation workshops, focus groups, surveys, card sorting, cultural probes, and ethnographic research.

Quality over quantity: 8-12 well-conducted sessions typically provide better insights than 50 rushed ones. Focus on depth and proper analysis.

Tools streamline the process: Platforms like Lyssna handle recruitment, transcription, and analysis, letting you focus on generating insights rather than logistics.

Practice builds expertise: Start with simpler methods like interviews and surveys before attempting complex ethnographic studies. Each method has specific skills to develop.

Pick your method

Which research method fits your project? Test Lyssna's research tools with our comprehensive free plan.

Generative UX research methods comparison

Choosing the right method depends on your research goals, timeline, and constraints. Here's a quick reference guide:

Method | Best For | Timeline | Sample Size | Key Output |

|---|---|---|---|---|

User interviews | Deep individual insights | 2-3 weeks | 8-12 people | Motivations, mental models |

Field studies | Real-world behavior | 3-4 weeks | 6-10 people | Context, workarounds |

Contextual inquiry | Task understanding | 2-3 weeks | 8-12 people | Workflow optimization |

Diary studies | Long-term patterns | 4-8 weeks | 10-15 people | Behavior over time |

Co-creation | Solution ideation | 1-2 weeks | 6-8 people | Collaborative solutions |

Focus groups | Social dynamics | 1-2 weeks | 6-8 per group | Group perspectives |

Surveys | Broad validation | 1-2 weeks | 50+ people | Pattern validation |

Card sorting | Information architecture | 1-2 weeks | 15-30 people | Mental models |

Cultural probes | Emotional context | 2-4 weeks | 8-12 people | Cultural insights |

Choosing the right generative research method

The effectiveness of your generative research depends heavily on selecting methods that align with your research goals, timeline, and available resources. Different methods reveal different types of insights, so understanding when and how to use each approach is crucial for success.

Method selection framework

Before diving into specific techniques, consider these key factors that should guide your method selection:

Research objectives and depth needed

Broad exploration: Use surveys and focus groups to understand general attitudes.

Deep individual insights: Choose interviews and diary studies for personal experiences.

Behavioral understanding: Employ field studies and contextual inquiry for real-world actions.

Collaborative ideation: Select co-creation workshops and participatory design.

Timeline and resource constraints

Method Type | Timeline | Resource Requirements | Participant Commitment |

|---|---|---|---|

Quick insights | 1-2 weeks | Low | Minimal (surveys, card sorting) |

Moderate depth | 3-4 weeks | Medium | Moderate (interviews, focus groups) |

Deep exploration | 4-8 weeks | High | Significant (diary studies, ethnography) |

Collaborative | 2-4 weeks | Medium-High | High engagement (workshops, co-creation) |

Participant accessibility and context

Remote-friendly: Interviews, surveys, diary studies, online card sorting.

In-person required: Field studies, some workshops, contextual inquiry.

Natural environment: Ethnographic studies, contextual inquiry, diary studies.

Controlled setting: Focus groups, workshops, some interview formats.

User interviews

Curious about why your audience makes the choices they do? Start by asking them directly in a user interview, but don't stop at the first answer. Keep the conversation open-ended, and dig deeper to uncover the real drivers behind their behaviors.

When to use in-depth interviews

In-depth interviews are your go-to method when you need to understand the "why" behind user behaviors, motivations, and decision-making processes. They're particularly powerful for:

Exploring personal experiences and emotions:

Understanding how users feel about current solutions.

Uncovering emotional drivers behind product choices.

Discovering personal workarounds and coping strategies.

Investigating complex decision-making processes:

Learning about multi-step user journeys.

Understanding how users evaluate options.

Exploring the factors that influence purchase or adoption decisions.

Discovering unmet needs and pain points:

Identifying gaps in current solutions.

Understanding why users abandon certain tasks.

Uncovering problems users have learned to live with.

Best practices for conducting interviews

Preparation essentials:

Create an interview guide with open-ended questions, but stay flexible.

Plan for 45-60 minutes to allow for deep exploration.

Test your recording setup and have backup options.

Research participants beforehand to personalize questions.

During the interview:

Start with easy, contextual questions to build rapport.

Use the "5 whys" technique to dig deeper into responses.

Pay attention to body language and emotional reactions.

Ask for specific examples and stories, not general opinions.

Sample question progression:

Opening: "Tell me about a typical day when you use [product category]"

Context: "Walk me through the last time you encountered [specific situation]"

Emotional: "How did that make you feel? What was frustrating about it?"

Behavioral: "Can you show me exactly how you handle this now?"

Aspirational: "If you had a magic wand, how would this work instead?"

Read more: Our user research interview questions guide covers 30+ user interview questions, with real examples and tips to help you ask the right questions.

Analysis and synthesis techniques

Immediate post-interview actions:

Write a brief summary while the session is fresh in memory.

Note key quotes, surprising insights, and emotional reactions.

Identify follow-up questions for future sessions.

Pattern identification across interviews:

Use affinity diagramming to group similar insights.

Look for both commonalities and interesting outliers.

Create theme hierarchies from specific observations to broader patterns.

With Lyssna's user interview capabilities and automatic transcription features, you can focus on the conversation while the platform handles the recording storage, making your analysis more efficient and thorough.

Field studies and ethnographic research

Field studies allow you to watch users in their everyday settings, revealing how they interact with products and navigate their routines. This isn't about evaluating what exists – it's about discovering what could be.

Understanding field studies vs ethnographic research

While these terms are sometimes used interchangeably, they have distinct characteristics and applications:

Field studies:

Duration: Hours to days.

Focus: Specific tasks or product interactions.

Setting: User's natural environment.

Goal: Understand behavior in context.

Ethnographic research:

Duration: Weeks to months.

Focus: Cultural patterns and social dynamics.

Setting: Deep immersion in user communities.

Goal: Understand lifestyle and cultural influences.

When field studies reveal breakthrough insights

Observing real-world constraints:

See how environmental factors affect product use.

Understand multitasking and interruption patterns.

Discover workarounds users have developed.

Uncovering gaps between stated and actual behavior:

Users often can't accurately recall their own behaviors.

Social desirability bias affects interview responses.

Real context reveals true priorities and decision-making.

Planning and executing field studies

Preparation phase:

Define observation objectives clearly but remain open to unexpected discoveries.

Recruit participants who are comfortable being observed in their space.

Plan logistics including travel, scheduling, and equipment needs.

Prepare observation frameworks to ensure consistent data collection.

During the field study:

Be a respectful observer – minimize disruption to natural behaviors.

Document both actions and environment – note contextual factors that influence behavior.

Ask clarifying questions when appropriate, but don't interrupt natural flow.

Capture artifacts like tools, workarounds, or environmental adaptations users have created.

Analysis approach:

Map user behaviors to environmental triggers and constraints.

Identify patterns across different user contexts and settings.

Look for innovative workarounds that suggest product opportunities.

Create environmental personas that capture different usage contexts.

Ethical considerations and best practices

Privacy and consent:

Obtain explicit permission to observe and record.

Be transparent about how data will be used.

Respect boundaries around sensitive or private activities.

Allow participants to pause observation when needed.

Cultural sensitivity:

Understand cultural norms in the environments you're studying.

Be aware of your own biases as an observer.

Respect family dynamics and social hierarchies.

Adapt your approach to different cultural contexts.

Contextual inquiry

Contextual inquiry combines observation and interviewing, allowing you to watch users perform tasks in real time while asking them why they do what they do. It's like having a front-row seat to your users' decision-making process.

The contextual inquiry approach

Unlike pure observation or traditional interviews, contextual inquiry uses a master-apprentice model where you learn from users as they demonstrate their expertise in their own environment.

Core principles:

Context: Observe in the user's actual work environment.

Partnership: Work collaboratively with users as the domain experts.

Interpretation: Understand not just what users do, but why they do it.

Focus: Maintain clear research objectives while remaining open to discovery.

When contextual inquiry provides unique value

Understanding complex workflows:

Multi-step processes that users have optimized over time.

How users coordinate with tools, systems, and other people.

Decision points that happen in real-time during task execution.

Discovering tacit knowledge:

Muscle memory and automatic behaviors.

Environmental cues that trigger certain actions.

Subtle indicators they use to make decisions.

Example application: Understanding how a remote worker organizes their day reveals not just their scheduling preferences, but how they manage energy levels, handle interruptions, coordinate with colleagues across time zones, and maintain work-life boundaries – insights that wouldn't emerge from a traditional interview.

Conducting effective contextual inquiry

Session structure:

Introduction (5 minutes): Explain the process and establish partnership.

Observation period (20-30 minutes): Watch natural task performance.

Interview period (15-20 minutes): Discuss what you observed.

Wrap-up (5 minutes): Clarify understanding and next steps.

During observation:

Stay quiet initially to see natural behavior.

Take detailed notes about sequence, tools, and decision points.

Note environmental factors that influence behavior.

Identify moments of confusion, frustration, or delight.

During the interview portion:

Ask about specific moments you observed.

Understand the reasoning behind certain choices.

Explore alternatives and workarounds.

Discuss ideal scenarios and current limitations.

Sample contextual inquiry questions:

"I noticed you switched between these two tools – can you tell me about that decision?"

"What were you thinking about when you paused there?"

"How does this process usually go? Was today typical?"

"What would make this easier for you?"

"Who else is affected by how you do this task?"

Turning contextual insights into design opportunities

Workflow optimization:

Identify steps that could be eliminated or automated.

Discover opportunities to better support natural user sequences.

Understand integration points between different tools and systems.

Environmental design:

Learn how physical or digital environment could better support tasks.

Identify information that needs to be more accessible at key decision points.

Understand how context switching affects user performance.

Diary studies and longitudinal research

Ever wish you could be a fly on the wall of your users' day-to-day life? Diary studies get you pretty close. Participants log their activities, thoughts, and interactions with your product over time, providing rich, ongoing data.

Understanding diary studies

Diary studies capture longitudinal insights into user behavior, emotions, and experiences by asking participants to record their activities, thoughts, and experiences related to a specific topic over a certain period.

Key characteristics:

Self-reported data: Participants document their own experiences.

Longitudinal perspective: Captures changes and patterns over time.

Natural context: Data collection happens in real-world settings.

Rich detail: Combines behavioral observations with emotional reactions.

When diary studies provide unique insights

Capturing long-term usage patterns:

How usage patterns change over time.

Seasonal or cyclical behaviors.

Learning curves and adaptation processes.

Long-term satisfaction and engagement trends.

Understanding complex user journeys:

Health and wellness behavior changes.

Financial planning and decision-making.

Learning new skills or adopting new habits.

B2B purchasing processes with multiple stakeholders.

Understanding context variations:

How the same user behaves differently across situations.

Environmental factors that influence product use.

Mood, energy, and other personal factors that affect experience.

Example application: How someone uses a fitness app over several weeks reveals not just their exercise patterns, but how motivation fluctuates, what external factors derail their routines, how they recover from setbacks, and what features become more or less important over time.

Designing effective diary studies

Study structure decisions:

Study Length | Best For | Participant Burden | Data Richness |

|---|---|---|---|

1-2 weeks | Habit formation, onboarding | Low | Moderate |

3-4 weeks | Behavior patterns, seasonal changes | Moderate | High |

2-3 months | Long-term adoption, lifecycle understanding | High | Very High |

Data collection methods:

Text entries: Detailed thoughts and experiences.

Photos: Visual context and environmental factors.

Screenshots: Digital interactions and interfaces.

Voice recordings: Quick capture of immediate reactions.

Structured prompts: Consistent data points across participants.

Participant engagement strategies

Reducing dropout rates:

Clear expectations: Explain time commitment upfront (e.g. 5-10 minutes per day).

Flexible timing: Allow participants to choose when they make entries.

Regular check-ins: Provide support and maintain engagement without being intrusive.

Incentive structure: Consider progressive rewards that increase over time.

Making it easy to participate:

Simple tools: Use familiar platforms like text messaging, email, or simple apps.

Reminder systems: Gentle prompts without being annoying.

Template prompts: Provide structure while allowing flexibility.

Sample diary prompts:

Daily: "Describe one interaction with [product category] today and how it made you feel"

Weekly: "Looking back at this week, what worked well and what was frustrating?"

Situational: "When you encountered [specific situation], what did you do and why?"

Reflective: "How has your approach to [activity] changed since starting this study?"

Analysis techniques for longitudinal data

Temporal pattern analysis:

Look for trends over time in behavior, sentiment, or usage.

Identify cyclical patterns (daily, weekly, monthly).

Spot critical moments that lead to behavior change.

Understand how external events influence user experience.

Individual journey mapping:

Create detailed timelines for each participant.

Identify key moments of delight, frustration, or decision.

Track how user goals and needs evolve over time.

Understand individual difference in adoption and usage patterns.

Cross-participant synthesis:

Find common patterns across different user types.

Identify universal pain points and moments of delight.

Understand how different contexts affect similar users.

Discover opportunities that apply broadly vs. specific segments.

Co-creation workshops and participatory design

Why not bring your users into the design process? Workshops and co-creation sessions invite users, designers, and other stakeholders to collaborate on developing solutions together. It's a powerful way to make sure the final product is shaped by those who will actually use it.

Understanding participatory design

Participatory design flips the traditional research dynamic by making users active collaborators in the solution development process rather than passive subjects of study.

Core principles:

Users as experts: Recognize that users are experts in their own experiences.

Collaborative creation: Work together to generate solutions, not just identify problems.

Iterative development: Build and refine ideas through multiple rounds of collaboration.

Democratized design: Give users agency in shaping solutions that affect them.

When co-creation workshops deliver unique value

Breaking through assumption barriers:

Challenging designer and developer assumptions in real time.

Revealing user mental models directly through their participation.

Exposing gap between what teams think users want and what users actually need.

Generating innovative solutions:

Novel approaches based on real-world experience and constraints.

Combinations of existing solutions that teams hadn't considered.

Insights into what would actually work in users' real contexts.

Building user buy-in and engagement:

Higher likelihood of adoption when users feel ownership.

Better understanding of design rationale among the user community.

Natural advocates who can help explain solutions to other users.

Planning effective co-creation sessions

Pre-workshop preparation:

Define clear objectives while leaving room for unexpected directions.

Select diverse participants representing different user segments and experience levels.

Prepare materials and activities that encourage creative thinking.

Brief facilitators on balancing structure with creative freedom.

Participant recruitment strategy:

Mix user types: Include both power users and newcomers.

Consider group dynamics: Balance vocal and quiet personalities.

Recruit the ideal number of participants: Plan for 6-8 participants to maintain manageable group size.

Screen for collaboration skills: Look for people comfortable working with others

Workshop structure and activities:

Phase | Duration | Activities | Goals |

|---|---|---|---|

Warm-up | 15-20 min | Introductions, ice breakers | Build comfort and rapport |

Problem exploration | 30-45 min | Journey mapping, pain point identification | Align on key challenges |

Ideation | 45-60 min | Brainstorming, sketching, concept development | Generate diverse solutions |

Prototyping | 60-90 min | Low-fi mockups, storyboards, role playing | Make ideas tangible |

Feedback and iteration | 30-45 min | Critique, refinement, prioritization | Improve and focus concepts |

Facilitation best practices

Creating psychological safety:

Emphasize that all ideas are valuable.

Encourage building on others' ideas rather than competing.

Address power dynamics between users and company representatives.

Make it clear that criticism should focus on ideas, not people.

Managing group dynamics:

Encourage quiet participants through small group work and written exercises.

Manage dominant voices by setting time limits and rotating speaking opportunities.

Bridge different perspectives by helping participants understand each other's viewpoints.

Keep energy high through varied activities and regular breaks.

Capturing insights effectively:

Assign dedicated note-takers who aren't facilitating.

Use visual documentation (photos, video) of prototypes and activities.

Record key quotes and moments of insight or excitement.

Create artifact collections of sketches, prototypes, and written outputs.

Turning co-creation outputs into actionable insights

Immediate synthesis:

Debrief with the team immediately after the session while observations are fresh.

Organize outputs by themes, user segments, or solution categories.

Identify highest-energy concepts that generated most participant excitement.

Note surprising insights that challenged team assumptions.

Solution development process:

Refine promising concepts based on technical feasibility and business viability.

Test refined concepts with broader user groups through other research methods.

Maintain connection with workshop participants for ongoing feedback.

Close the loop by sharing how their input influenced final solutions.

Focus groups for generative research

Focus groups for generative research differ significantly from traditional market research focus groups. Instead of testing concepts or gathering reactions, generative focus groups explore user experiences, unmet needs, and collaborative problem-solving.

Reframing focus groups for discovery

Traditional vs generative focus groups:

Traditional Focus Groups | Generative Focus Groups |

|---|---|

Test specific concepts or messages | Explore problem spaces and user experiences |

Gather reactions and preferences | Understand motivations and behaviors |

Validate existing ideas | Generate new insights and opportunities |

Moderator-driven conversation | Participant-driven discussion |

Focus on what people say they want | Understand why people behave as they do |

When focus groups excel in generative research

Exploring social and cultural dynamics:

How social norms influence individual behavior.

Group decision-making processes.

Cultural attitudes and shared mental models.

Peer influence on product adoption and usage.

Discovering diverse perspectives efficiently:

Gather multiple viewpoints in a single session.

See how different user types interact and influence each other.

Identify consensus views vs outlier perspectives.

Understand how opinions form and change through discussion.

Building on shared experiences:

"That reminds me of when I..." moments that reveal new use cases.

Shared frustrations that validate problem importance.

Collaborative problem-solving that generates solution ideas.

Conducting generative focus groups effectively

Group composition strategy:

Homogeneous groups for deep exploration within specific user segments.

Mixed groups when you need to understand interactions between different user types.

Size considerations: 6-8 participants for most topics, smaller for sensitive subjects.

Creating generative discussion:

Start with individual reflection before group discussion.

Use projective techniques like "If this product were a person, who would it be?"

Encourage storytelling through prompts like "Tell us about a time when..."

Build on responses with follow-up questions that dig deeper.

Sample generative focus group activities:

Experience mapping: Have participants collectively map out their typical user journey, identifying pain points and moments of delight.

Problem prioritization: Present various challenges and have the group discuss and rank them based on personal experience.

Solution brainstorming: After identifying problems, facilitate group ideation around potential solutions.

Persona validation: Share draft personas and have participants react, refine, and add details based on their experiences.

Managing focus group limitations

Avoiding groupthink:

Start with individual written responses before group discussion.

Explicitly ask for dissenting opinions.

Use anonymous input methods for sensitive topics.

Validate findings through other research methods.

Handling dominant personalities:

Set ground rules about equal participation.

Use structured activities that give everyone a chance to contribute.

Break into smaller groups for part of the session.

Follow up with quieter participants individually if needed.

Ensuring authentic responses:

Create psychological safety for honest sharing.

Acknowledge that there are no right or wrong answers.

Use concrete examples rather than hypothetical scenarios.

Pay attention to non-verbal cues that might contradict verbal responses.

Exploratory surveys

Surveys don't have to be all checkboxes and scales. When designed with open-ended questions, they can be a powerful generative tool that provides broad insights while maintaining the depth needed for discovery research.

Designing surveys for generative insights

Instead of limiting responses to predefined options, open-ended surveys invite users to express their thoughts in their own words, revealing:

Unexpected use cases and applications.

Language and terminology users naturally use.

Emotional reactions and personal stories.

Problems and solutions you hadn't considered.

Strategic question design:

Question Type | Purpose | Example |

|---|---|---|

Experience questions | Understand current behavior | "Describe the last time you tried to accomplish [goal]. Walk me through what happened." |

Problem exploration | Identify pain points | "What's the most frustrating part of [process/experience]? Tell me about a specific time this happened." |

Aspiration questions | Discover unmet needs | "If you could wave a magic wand and change one thing about [domain], what would it be and why?" |

Context questions | Understand usage patterns | "In what situations do you find yourself needing to [task]? Describe a typical scenario." |

When surveys scale generative insights

Validating patterns from qualitative research:

Confirm that pain points identified in small-scale research affect users generally.

Understand the relative importance of different problems or needs.

Identify which user segments are most affected by specific issues.

Reaching users you can't interview:

Users in different time zones or with scheduling constraints.

Sensitive topics where anonymity encourages honesty.

Large user bases where individual interviews aren't feasible.

Example applications:

Following up on interview insights with broader user validation.

Exploring seasonal or temporal patterns across many users.

Understanding rare use cases that might not surface in small interview studies.

Crafting effective open-ended survey questions

Question structure best practices:

Start specific, then broaden, for example, “Think about the last time you used [product] on your phone,” followed by:

What were you trying to accomplish?

What made that experience successful or frustrating?

How could it have been better?"

Use scenario-based prompts, for example, “Imagine you're trying to [accomplish goal] but you're interrupted by [common disruption],” followed by:

How do you typically handle this situation?

What goes through your mind when this happens?

What would help you get back on track?"

Encourage storytelling, for example, "Tell us about a time when [product category] really helped you solve a problem,” followed by:

What was the situation?

Why was this solution particularly helpful?

How did it make you feel?"

Analysis techniques for open-ended survey data

Thematic analysis approach:

Read through all responses to get a sense of the overall themes.

Code responses by identifying key concepts, emotions, and behaviors.

Group similar codes into broader themes and patterns.

Quantify themes to understand their relative frequency and importance.

Look for segments based on different response patterns.

Identifying actionable insights:

Frequency analysis: What problems or needs come up most often?

Sentiment analysis: What generates strong emotional reactions?

Language analysis: How do users naturally describe their experiences?

Segmentation: Do different user types have different needs or experiences?

With Lyssna's survey capabilities, you can easily create open-ended questions, collect responses at scale, and use analysis features to identify patterns and themes across large numbers of responses. The platform's tagging and filtering capabilities help you segment responses and identify the most common and impactful insights.

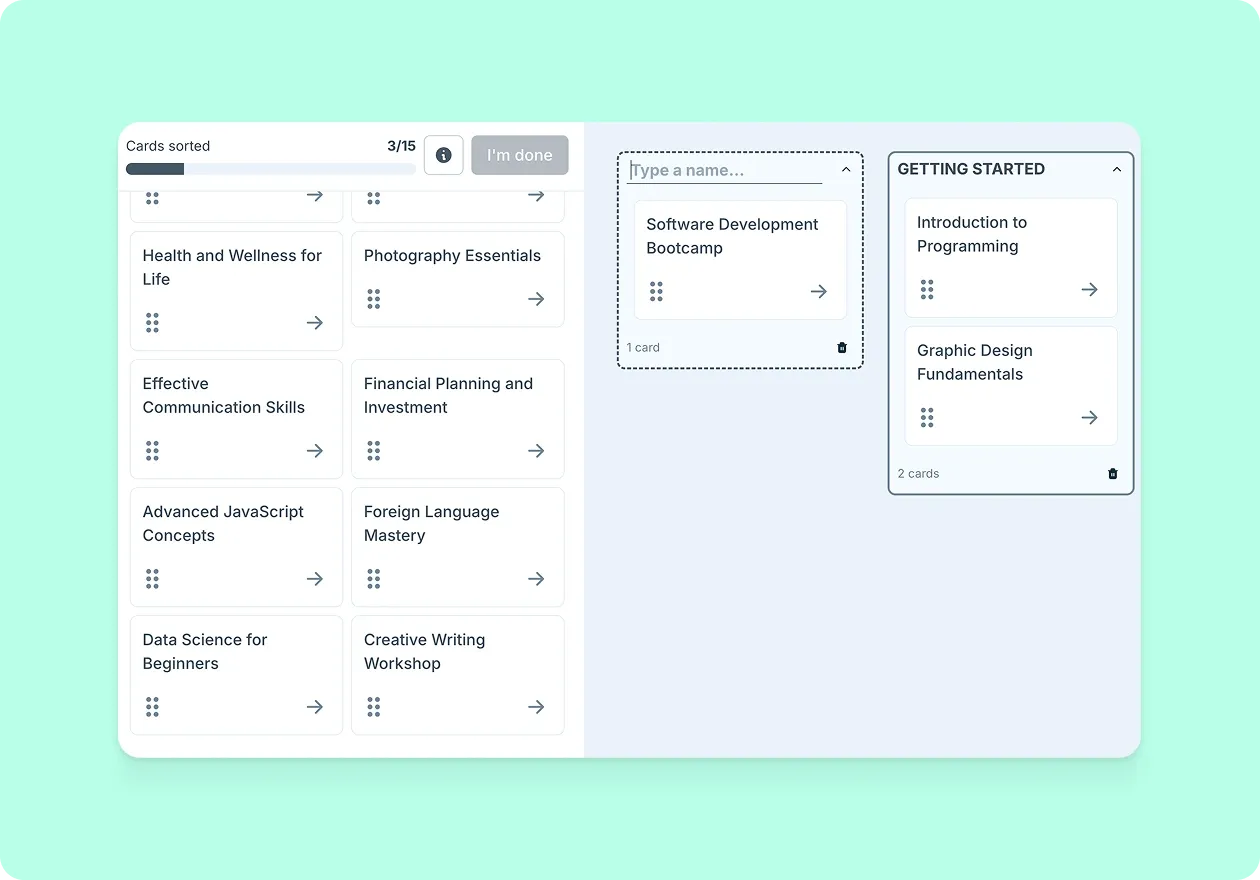

Open card sorting

Want to understand how to organize information or content on your website or app? Open card sorting is one of the most effective generative research methods where users are provided with cards with different content and information, then asked to group them in the most meaningful way.

Understanding open vs closed card sorting

Open card sorting (generative):

Participants create their own categories and labels.

Reveals users' natural mental models.

Discovers unexpected groupings and relationships.

Generates ideas for information architecture.

Closed card sorting (evaluative):

Participants sort cards into predefined categories.

Tests existing information architecture concepts.

Validates whether proposed structures make sense to users.

Measures consistency of categorization.

For generative research purposes, open card sorting provides the richest insights into how users naturally think about information relationships.

When card sorting reveals mental models

Information architecture development:

Organize large amounts of content or features.

Understand how users naturally group related concepts.

Create navigation structures that match user expectations.

Develop taxonomy and labeling that users will understand.

Discovering unexpected relationships:

Functional groupings (tasks they accomplish together).

Contextual groupings (situations where they use items together).

Emotional groupings (items that evoke similar feelings).

Importance-based groupings (priority levels for different features).

Example applications:

Ecommerce site navigation based on how customers think about product categories.

Software feature organization based on user workflow patterns.

Content organization for knowledge bases or help systems.

Mobile app information architecture that matches user task flows.

Conducting effective card sorting sessions

Preparation steps:

Select representative content – choose 30-60 cards that represent your key content or features.

Create clear card labels – use terms that are specific enough to be meaningful but not so detailed that they bias grouping.

Brief participants – explain the process without influencing their thinking.

During the sorting session:

Start with individual sorting before any group discussion.

Encourage thinking aloud to understand reasoning behind groupings.

Don't guide or correct – let users create whatever groupings make sense to them.

Ask about category labels – understand how users would name the groups they create.

Analyzing card sorting results

Individual analysis:

Document each participant's categories and reasoning.

Note cards that participants struggled to categorize.

Identify items that consistently grouped together across participants.

Observe different mental models represented by different grouping strategies.

Cross-participant synthesis:

Similarity analysis: Which cards are most frequently grouped together?

Category analysis: What types of groupings do people naturally create?

Labeling patterns: How do different people describe similar groupings?

Outlier investigation: Why do some participants group things differently?

Turning insights into information architecture:

Create category structures based on the most common groupings.

Use participant language for navigation labels and descriptions.

Plan for items that don't fit neatly into single categories.

Consider multiple navigation paths for items that group differently depending on context.

Tools for card sorting: Lyssna offers digital card sorting capabilities that make it easy to conduct remote studies, automatically capture results, and analyze patterns across participants. This is particularly valuable when you need to conduct card sorting with geographically distributed users or want to scale the research across larger participant groups.

Get started with the below open card sorting template:

Cultural probes and creative methods

Cultural probes use artifacts and activities to elicit detailed responses from users about their experiences, emotions, and contexts. This method is particularly powerful for understanding cultural nuances, personal meanings, and emotional relationships with products or experiences.

Understanding cultural probes

Cultural probes are collections of evocative tasks and artifacts designed to inspire users to document and reflect on their experiences in creative ways. Originally developed by Bill Gaver and his colleagues, this method encourages users to become co-researchers in exploring their own lives.

Key characteristics:

Self-directed: Users complete activities independently.

Creative expression: Encourages non-verbal and artistic responses.

Personal reflection: Prompts deep thinking about experiences and meanings.

Cultural sensitivity: Reveals how cultural context shapes user experiences.

When cultural probes reveal unique insights

Understanding emotional relationships:

How products fit into users' personal identity.

Emotional attachments and meanings users associate with experiences.

Cultural values that influence product perception and use.

Personal rituals and practices around product usage.

Exploring sensitive or private topics:

Personal health and wellness practices.

Financial behaviors and attitudes.

Family dynamics and relationships.

Cultural or religious influences on behavior.

Discovering unspoken needs:

Unconscious behaviors and preferences.

Cultural assumptions about how things "should" work.

Social norms that influence individual choices.

Aspirational values that drive decision-making.

Designing effective cultural probe packages

Common probe activities:

Activity Type | Purpose | Example |

|---|---|---|

Photography tasks | Capture visual context | "Take photos of all the spaces where you use [product]" |

Diary keeping | Document experiences over time | "Keep a record of your emotions each time you use [service]" |

Mapping exercises | Understand relationships | "Draw a map of your typical day, marking moments of stress and joy" |

Creative artifacts | Express complex feelings | "Create a collage that represents your ideal [experience]" |

Storytelling prompts | Reveal personal narratives | "Write a letter to [product] as if it were a friend" |

Package composition guidelines:

Mix activity types to accommodate different expression preferences.

Provide clear but open-ended instructions that encourage creativity.

Include all necessary materials (cameras, journals, art supplies).

Set realistic expectations for time commitment and output.

Example cultural probe study

Objective: Understanding how families incorporate technology into their daily routines and spaces.

Probe activities:

Photo diary: "For one week, take photos every time someone in your family uses a digital device. Include a brief note about what was happening."

Space mapping: "Create a floor plan of your home and mark where technology lives and moves throughout the day."

Emotion tracking: "Each evening, draw or write about how technology made you feel that day - frustrated, connected, overwhelmed, etc."

Future visioning: "Create a collage or drawing showing how you wish your family used technology."

Analyzing cultural probe data

Individual interpretation:

Review each participant's materials holistically, looking for emotional themes.

Note creative choices and what they reveal about values and priorities.

Identify contradictions between different activities or expressed attitudes.

Cross-participant synthesis:

Look for cultural patterns and shared values across families.

Identify unique adaptations and personal meanings.

Understand how context shapes technology relationships.

Turning insights into design opportunities:

Translate emotional insights into functional requirements.

Identify cultural barriers to adoption or engagement.

Discover opportunities for products that align with personal values.

Combining generative UX research methods

The comprehensive approach:

Start broad with surveys to identify key themes and user segments.

Go deep with interviews to understand individual motivations.

Observe reality through field studies or contextual inquiry.

Validate insights with additional surveys or card sorting.

Co-create solutions through workshops with users.

Resource-efficient combinations:

Interviews + surveys: Scale qualitative insights quantitatively.

Diary studies + follow-up interviews: Combine patterns with explanations.

Card sorting + contextual inquiry: Understand both structure and workflow.

Cultural probes + interviews: Combine emotional depth with rational explanation.

Quality assurance across methods:

Recruit diverse participants representing your full user base.

Use consistent analysis approaches across different methods.

Triangulate findings using multiple data sources.

Validate surprising insights with follow-up research.

The key to successful generative research lies not in perfecting any single method, but in thoughtfully combining approaches that reveal different facets of the user experience. Start with the methods that feel most accessible to your team and gradually build expertise in more complex approaches.

With platforms like Lyssna supporting your entire research workflow - from participant recruitment to analysis - you can focus on generating insights rather than managing logistics, making it easier to implement these methods effectively regardless of your experience level.

Launch your study

Stop planning, start researching. Execute any of these methods with Lyssna's streamlined platform – try free today.

FAQs about generative UX research methods

Diane Leyman

Senior Content Marketing Manager

Diane Leyman is the Senior Content Marketing Manager at Lyssna. She brings extensive experience in content strategy and management within the SaaS industry, along with editorial and content roles in publishing and the not-for-profit sector

You may also like these articles

Try for free today

Join over 320,000+ marketers, designers, researchers, and product leaders who use Lyssna to make data-driven decisions.

No credit card required